Sifting through the myriad of online trading platforms available today can be an overwhelming task. As scams unfortunately plague the internet, it has become imperative to deeply scrutinize the authenticity of each platform. This article presents a detailed FiniWise review, taking into account its services, regulatory status, and user experiences to ascertain its trustworthiness and dependability.

What is FiniWise?

FiniWise, established in 2016, has gradually built its reputation to become a reputable player in the realm of online trading platforms. FiniWise specializes in Contracts for Difference (CFDs) and provides a diverse array of six asset classes - Forex, shares, indices, crypto, spot metals, and spot energies. This FiniWise review identifies the platform's wide-ranging offerings and stable operating environment as potential signs of its trustworthiness.

Evaluating FiniWise's Legitimacy: Regulatory and Reputation Insights

In the ever-evolving digital trading, scam rumors are ubiquitous. Therefore, a platform's regulatory credentials play a pivotal role in confirming its legitimacy. These rigorous legal standards considerably diminish the probability of FiniWise being a scam.

Furthermore, FiniWise's robust reputation is bolstered by the existence of a license issued by the British Virgin Islands Financial Services Commission, a physical office, a verifiable track record, and multiple industry awards. While no platform can assure total protection from operational issues or guarantee 100% user satisfaction, these elements collectively suggest FiniWise operates in a genuine manner.

FiniWise's Industry Footprint and Financial Security Measures

FiniWise's significant footprint in the trading industry, coupled with its strong regulatory and operational framework, gives evidence of its legitimacy. FiniWise further boosts its credibility by segregating client funds from its operating capital, a practice that assures greater transparency and financial security for its clients.

In addition, FiniWise's affiliations with high-profile sports teams reflect a level of public credibility and trust that is rarely linked with fraudulent activities.

FiniWise Pros and Cons

Pros:

- Regulatory Compliance: FiniWise operates under the watchful eye of the British Virgin Islands Financial Services Commission, ensuring strict adherence to international financial standards.

- Diverse Asset Selection: Traders can broaden their portfolios with access to CFDs across forex, shares, indices, cryptocurrencies, energy commodities, and metals.

- Multiple Trading Platforms: FiniWise caters to diverse trading preferences with a range of platforms, including MetaTrader 4, MetaTrader 5, WebTrader, and its proprietary FiniWise Edge platform.

- Client Fund Protection: Segregated accounts ensure that client funds remain separate from the company's operational funds, adding an extra layer of security for traders.

- Positive Reputation: FiniWise boasts generally positive online reviews across multiple platforms, reflecting its reliability and customer satisfaction.

- Professional Assistance: Traders can leverage the expertise of professional senior brokers and cutting-edge AI features to enhance their trading strategies.

Cons:

- Technical Glitches: Some users have reported occasional technical issues, although these are typically minor and infrequent.

- Customer Service: While most users have positive experiences, some encounter longer response times or less satisfactory assistance during peak periods.

- Educational Resources: Although FiniWise provides some educational materials, there's room for improvement in expanding resources for beginner traders.

FiniWise Trust and Safety

- Regulation: FiniWise is fully authorized and regulated by the British Virgin Islands Financial Services Commission, ensuring compliance with stringent financial standards and providing a secure trading environment.

- Fraud Prevention: Advanced encryption and continuous monitoring are employed to prevent fraudulent activities, safeguard traders from potential scams, and maintain transaction integrity.

- Client Fund Security: Client funds are held in segregated accounts, ensuring their protection even in adverse scenarios.

FiniWise Account Opening

Opening an account with FiniWise is straightforward and user-friendly, typically completed within one business day. With a minimum deposit requirement of $250, new users receive dedicated support to guide them through the process, ensuring a smooth start to their trading journey.

FiniWise Fees

FiniWise offers competitive spreads and swaps across all asset classes, with free deposits and zero withdrawal fees. However, an inactivity fee applies and spreads on stocks are relatively higher compared to other brokers. This transparent fee structure enables traders to manage their costs effectively.

FiniWise Deposit and Withdrawal Options

- Deposit Options: Traders can fund their accounts via debit/credit card (instant), E-transfer (for amounts below $10,000), wire transfer (for amounts above $9,999), and cryptocurrency payments (supported networks: BTC, ETH, TRON). Card payments are processed instantly, while wire transfers may take up to two business days.

- Withdrawal Options: Withdrawals are typically processed within two business days, ensuring timely access to funds.

FiniWise Trading Platform Reviews

Overall, user reviews of the FiniWise trading platform are generally positive. The intuitive interface, an extensive selection of tradable assets, fast withdrawals and competitive spreads have earned favorable feedback. FiniWise provides a variety of trading systems and its own FiniWise Edge platform.

However, some users have raised issues about customer service and KYC processes. Despite these complaints, the general consensus in this FiniWise review implies the platform puts its users first and maintains a reliable operation.

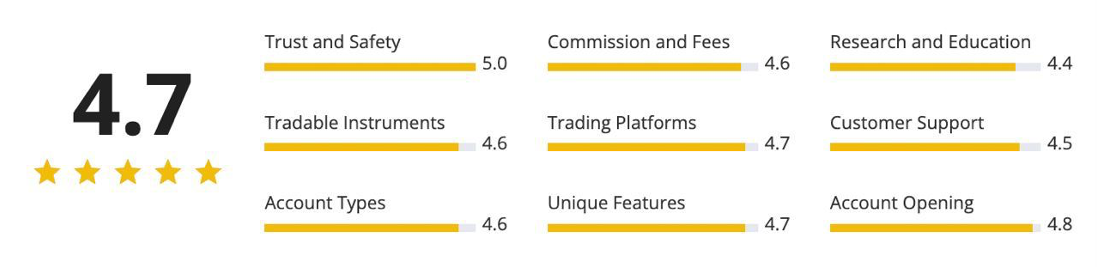

FiniWise offers a comprehensive trading experience suitable for traders of all levels. With its diverse asset offerings, multiple trading platforms, and stringent regulatory oversight, FiniWise stands as a reliable choice for online trading. While there are areas for improvement, such as addressing technical glitches and enhancing customer support, the platform's strengths make it a solid option for many traders.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment